Profit Potential: Exploring the World of Cfd trading

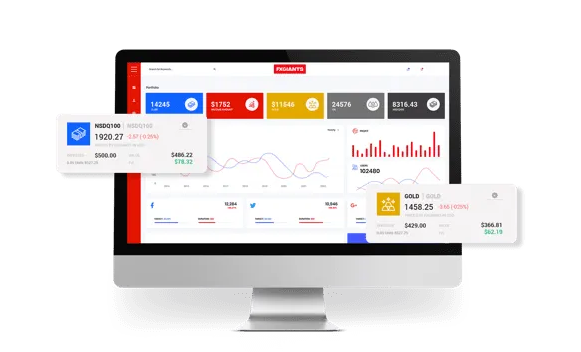

Are you seeking for an opportunity to invest in an extremely profitable market? If you’re interested in the world of finance, you might have heard of CFD (Contract for Difference) trading. Cfd trading enables investors and traders to speculate on the price changes of financial instruments such as commodities, currencies, and indices. This blog post will provide an in-depth overview of what Cfd trading is, how it works, and its potential profitability.

What is Cfd trading?

Cfd trading is an investment strategy that enables traders to buy and sell Contracts for Difference. A Contract for Difference is a financial derivative that lets investors speculate on the price movements of assets without owning the underlying asset. It operates by exchanging the difference in price from the time the contract is opened to when it is closed.

How does Cfd trading work?

Cfd trading enables investors to leverage their capital by trading on margin, meaning traders are only required to deposit a small percentage of the total value of the Contract for Difference. For instance, if a cfd trading platform offers a 10:1 leverage, investing $1000 in a CFD would provide exposure to a $10,000 position. This leverage increases potential profits and losses.

What are the benefits of Cfd trading?

Cfd trading offers several benefits, making it a popular form of trading among individual and institutional investors alike. For one, Cfd trading offers a range of available financial instruments, including forex, stocks, commodities, and indices. Additionally, the flexibility of trading on margin enables small investors to enter the market with a limited capital investment. Finally, there are no exchange fees when trading CFDs.

What are the risks involved in Cfd trading?

Cfd trading is naturally riskier than traditional investments, such as stocks or bonds. The high leverage can magnify losses if the market moves against you. Additionally, Cfd trading involves counterparty risk since there is a level of dependency on the broker’s ability to fulfill the contract.

short:

Cfd trading can be a profitable investment opportunity for investors seeking to maximize returns from the financial market. With flexible leverage and a range of tradable instruments, Cfd trading offers unparalleled opportunities for portfolio diversification. However, traders must be aware of the risks involved, including high leverage, counterparty risk, and complex pricing structures. Understanding these risks will enable traders to leverage the benefits of Cfd trading while minimizing potential losses.